Insight

June 20, 2016

Who Stole All the Manufacturing Jobs?

One of the most common arguments against international trade is that it leads to the loss of manufacturing jobs. Protectionists assert that the recent decline in manufacturing employment has been fueled by the rising U.S. trade deficit. Donald Trump is particularly vocal on this issue, accusing the North American Free Trade Agreement (NAFTA) of “clean(ing) out vast portions of our manufacturing businesses” and pledging to “bring jobs back to America” by breaking current trade deals.

While it is true that the number of manufacturing jobs has been dropping since the turn of the century, some argue that increases in worker productivity are actually to blame. Technological advancements have enabled manufacturers to increase production levels. This in turn has decreased demand for manufacturing labor. As candidates in the 2016 election cycle continue to cite manufacturing job losses as evidence against the value of trade, distinguishing between jobs lost to trade and productivity is increasingly valuable.

Several studies have attempted to answer this question. A 2015 report from the Economic Policy Institute (EPI) concluded that the slowing growth rate in manufacturing output is responsible for the decline in manufacturing employment. It further argues that, had manufacturing trade been balanced after 2000 (i.e. had there been no trade deficit), output would have been sufficient to ensure either stable or growing manufacturing employment over the last 15 years. However, there are several issues with this analysis.

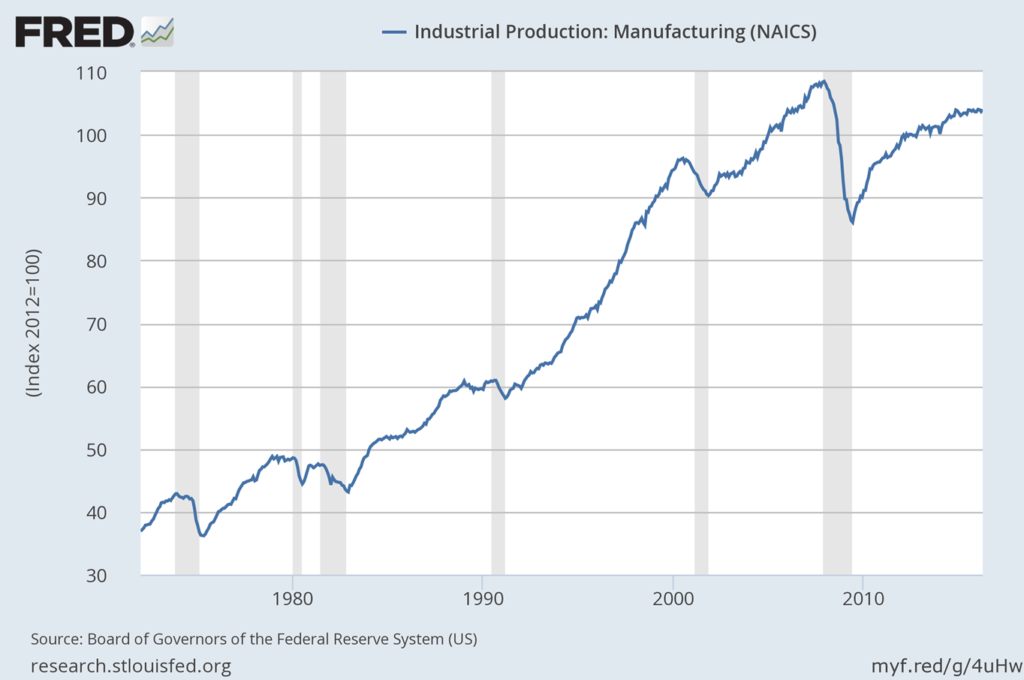

EPI calculated growth in manufacturing output by comparing average annual growth rates from 2000 to 2007 and from 2007 to 2014. Averaging growth rates during these particular time periods is misleading, as they include both the 2001 and 2009 recessions. The chart below from the Federal Reserve Bank of St. Louis shows that manufacturing output has generally increased over time. Output temporarily declines during recessions (represented by shaded areas), but always recovers in the following years.

The chart above confirms that U.S. manufacturing is flourishing. The industry was hit hard by the Great Recession, but output has consistently trended upward even while employment continues to fall. It also shows that major U.S. trade initiatives like NAFTA in 1994 and the creation of the World Trade Organization in 1995 did not reduce U.S. production levels.

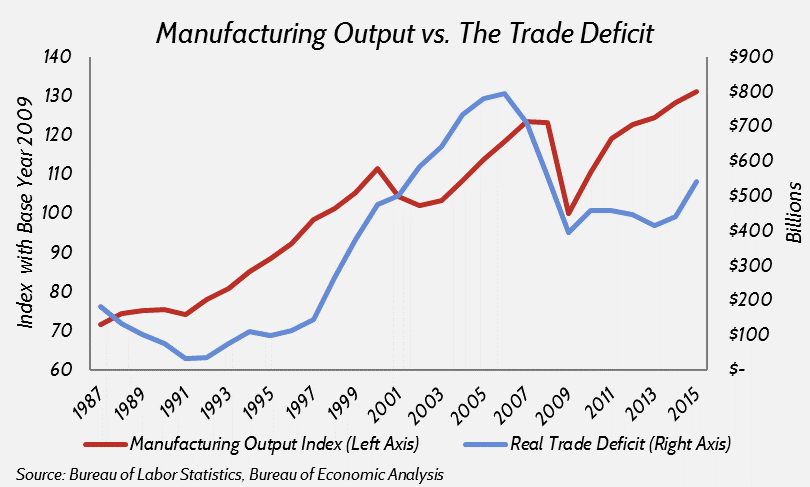

EPI argues that the rising U.S. trade deficit significantly damaged manufacturing. Directly comparing growth in both manufacturing output and the trade deficit, however, suggests that this is not the case. The chart below compares growth in the trade deficit and manufacturing output over the last two decades. From 1990 to 1997, output increased an average of 4.3 percent per year, while the trade deficit grew at an average annual rate of 12.8 percent. Growth in the trade deficit shot up to 76.3 percent per year from 1997 to 2000, but this jump did not cause manufacturing output to fall. Output growth remained steady at an annual average of 4.4 percent during that time.

Like the chart above, the chart below shows that manufacturing output is primarily responsive to economic recessions, not the trade deficit.

The Center for Business and Economic Research (CBER) conducted an analysis last year to determine which factors are most responsible for declining manufacturing employment. The report examined four key drivers: domestic consumption of manufactured goods, imports, exports, and labor productivity. They found that, of the 5.6 million manufacturing jobs lost from 2000 to 2010, roughly 87.8 percent were due to productivity gains. Only 13.4 percent of those job losses can be attributed to the negative trade balance.

CBER’s findings are not too surprising. They report that the value of manufactured goods per worker increased 67.5 percent from 2000 to 2010 across the entire manufacturing industry. Productivity growth was especially pronounced in the manufacturing of computer and electronic products, which soared 350 percent in just ten years. These advances were sparked by innovation, technological progress, and greater efficiency in the face of international competition, three things the United States prides itself on.

Developed countries around the world are experiencing similar trends in manufacturing employment. Germany, which consistently runs large trade surpluses, has been steadily losing manufacturing jobs for years. This demonstrates that the decline in manufacturing employment is a global phenomenon not necessarily linked to unbalanced trade.

Evidence shows that productivity gains have predominantly driven the recent declines in manufacturing employment. Even in the face of labor market shifts, the United States remains the second largest manufacturer in the world. And jobs that are displaced by trade are often replaced by new, higher-paying jobs in emerging sectors of the economy. The strength of the U.S. manufacturing industry is evident, and gains in productivity should be welcomed.